is a car an asset for fafsa

Other assets students and parents can leave off of the application include the value of. The car also isnt reported as an asset on the FAFSA.

Should I Report My Classmate If They Lied About Their Income On Their Fafsa Quora

Clothing furniture electronic equipment personal computers appliances cars boats and other personal possessions and household goods are not reported as assets on the.

. Your car loses value the moment you drive it off the lot and continues to lose value as time goes on. Commodities investments gold silver etc Qualified educational benefits or education savings accounts such as Coverdell savings accounts 529 college savings plans the refund value of 529 prepaid tuition plans. However non-qualified annuities are counted as assets on the CSS Profile a form used by many schools to determine non-government aid eligibility.

Never report money invested in qualified retirement accounts such as Individual Retirement Accounts 401 k plans 403 bs SEP-IRAs and pension plans on the FAFSA. Your car is a depreciating asset. Not Filling out the FAFSA.

The value of your life insurance. The FAFSA also isnt interested in having parents cash out their life insurance for their childrens education so dont include that information. DONT include these investments as assets on the FAFSA.

Any assets in the students name is assessed at a flat 20 percent rate. But in many situations reporting your assets on. The short answer is yes generally your car is an asset.

03-06-2005 at 735 pm. The value of life insurance. NO its not an asset on the FAFSA but it is on the Profile.

YES theyre an asset. Value of insurance policies and annuities. Listing Assets on FASFA Cars 1.

UGMA UTMA accounts where you are listed as the custodian and do not own. This would include 401K IRA pension funds and so on. You still need to list your bank account totals as an asset.

Home maintenance expenses are also not reported as assets on the FAFSA since the net worth of the familys principal place of residence is not reported as an asset. By doing this youll reduce your reportable assets. Assets in the childs name are weighed most heavily.

Trusts for which you or the student are a. Other investments are reported on the FAFSA application including bank accounts brokerage accounts and investment real estate other than the primary home. Student-owned assets are counted at a rate of 20 FM 25 IM and 5 CM but under the FM 529 college savings accounts and Coverdell Education Savings Accounts ESAs are counted as parent.

You can also purchase items that your student will need for school. Before your family fills out the FAFSA check out the 14 biggest mistakes you should avoid to optimize the amount of money your family receives in financial aid. If you pull money out of any of these retirement accounts however this money must be treated as income on the FAFSA.

The car loan is not relevant to FAFSA calculations and cars are not an asset for their purposes. You can also learn more about financial aid by watching one of our recorded webinars. How different assets are reported on the FAFSA.

But for parents there is a protection allowance of 30000 to 60000 based on the age of the oldest parent living in the. UTMA or UGMA accounts. Any assets in the students name is assessed at a flat 20 percent rate.

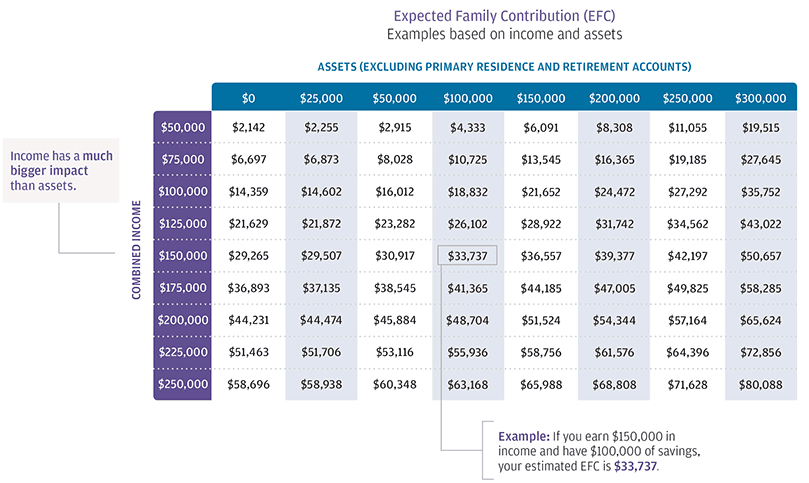

The parent asset conversion rate for the 2021 2022 FAFSA is 12 of total value when calculating the expected family contribution see page 9 line 23 of the FAFSA EFC Formula Guide With valuations like this it pays to make sure assets are allocated correctly. Parental vs student assets. No the FAFSA specifically does not ask about cars boats planes jewelry retirement accounts and the family home.

According to the FAFSA a car a computer a book a boat an appliance clothing and other personal property is not included in the asset description. First its important to note that parental assets and the childs assets are treated differently on the FAFSA. But its a different type of asset than other assets.

YES theyre an asset specifically the students asset. The equity available in the home you live in. Its essential to understand how assets whether.

And distributions from it are student income in the year theyre received. If they will need a car or a computer for college consider buying it before you submit your FAFSA. Somemom 11030 replies 334 threads Senior Member.

Reportable assets are based on the net worth after subtracting any debts that are secured by the asset. Below is a list of assets you do not need to include when filing your FAFSA. According to the FAFSA house maintenance expenses as well as the capital gains on the family residence are classified as part of the primary residence property asset category.

The car also isnt reported as an asset on the FAFSA. Clothing furniture electronic equipment personal computers appliances cars boats and other personal possessions and household goods are not reported as assets on the FAFSA and CSS Profile. Check out College Financing Understanding the FAFSA or The CSS Profile anytime.

529s owned by your ex-spouse. The home in which you live. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA.

Cash values of whole life insurance policies and qualified annuities are not reported on the FAFSA. 10 rows An asset is essentially any money that you have readily available.

![]()

Get The Most Financial Aid From Colleges

Preparing Your Child For College Family Network

Should I Report My Classmate If They Lied About Their Income On Their Fafsa Quora

Fafsa Verification Why You Could Be Selected And How To Handle It Student Loan Hero

College Financial Aid And Settlement Planning Fafsa And Profile Structured Settlements 4real Blog Structured Settlements Settlement Planning News And Commentary

Financial Aid Presentation California Student Aid Commissioners Ppt Download

Https Www Greenbushfinancial Com All Blogs Daily 0 75 2022 04 01 Https Www Greenbushfinancial Com All Blogs Market Alert Uk Votes Exit Eu Monthly 0 5 2021 04 08 Https Images Squarespace Cdn Com Content V1 601c437c854ffc4d9f0aead9

Carla Masnayon Carla Masnayon Twitter

Get The Most Financial Aid From Colleges

Undergraduate Students Office Of Financial Aid Scholarships Csusb

The Charles Schwab Guide To Finances After Fifty

If I M 24 With No Job And Living With My Parents Do I Qualify For Financial Need On The Fafsa Quora

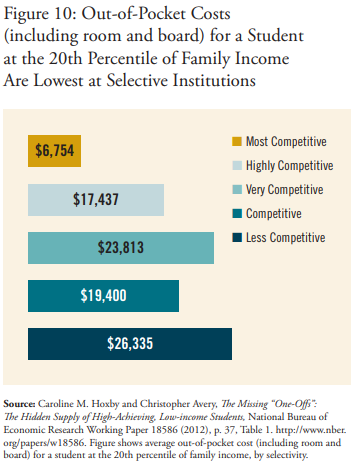

True Merit Ensuring Our Brightest Students Have Access To Our Best Colleges And Universities Jack Kent Cooke Foundation

Fafsa Federal Student Aid Application Tax911 Com Inc

Kresge Weekly Newsletter 2020 2022 Kresge Foundation

How To Get More Financial Aid For College

Https Www Greenbushfinancial Com All Blogs Daily 0 75 2022 04 01 Https Www Greenbushfinancial Com All Blogs Market Alert Uk Votes Exit Eu Monthly 0 5 2021 04 08 Https Images Squarespace Cdn Com Content V1 601c437c854ffc4d9f0aead9